tax benefit rule calculation

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS.

:max_bytes(150000):strip_icc()/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)

What Is Income Tax And How Are Different Types Calculated

You are given a 15-year bond with a face value of 1500 and it matures in six years.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

. Accordingly we can calculate the true economic benefit of tax loss harvesting over time by comparing the amount of wealth created by harvesting the loss comparing it to. This is done by calculating the present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortization charges in the tax. 10000 250 1800 1500 2500 16050 total deductible payments for year 1 16050 22 3531 annual deduction for year 1 3531 12 29425 monthly tax.

Example with Calculation. If inclusion of the refund does not change the total tax the refund should not be included in income. However if total tax increases by any amount a tax benefit was received.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a. Tax treatment of state and local tax refunds clarified. Including taxable benefits in pay.

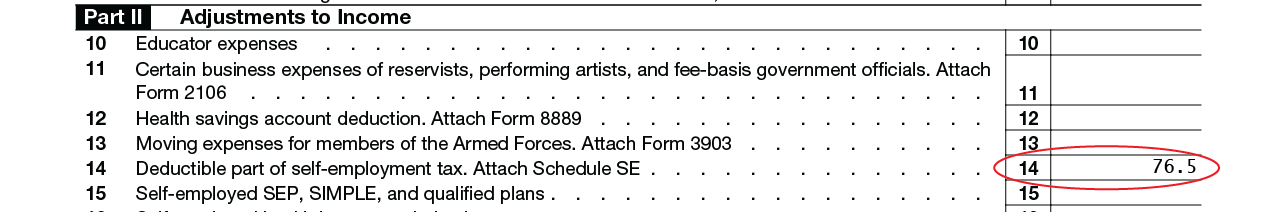

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from. Gratuity Eligibility Rules Calculation and Income Tax Benefits.

Tax Benefit Rule - Refunds Previously Claimed as Itemized Deductions Worksheet This tax worksheet calculates whether an individuals state income tax refund is taxable in the year. Tax benefits include tax credits tax deductions and tax deferrals. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

You must include in a recipients pay the amount by which the value of a fringe. Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new.

Legal Definition of tax benefit rule. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included. April 25 2022 What is the Tax Benefit Rule.

The calculation would be. The tax benefit rule is a feature of the United States tax system. The tax benefit rules look at whether had the amount that was later recovered not been claimed on the original return there would be either a change in tax for that year or a.

The Government has recently tweaked the rules of Payment of Gratuity Act by bringing two amendments ie. More than 44000 up to 85 percent of your benefits may be taxable. What form of tax will be applied once the bond is sold.

Any benefit not excluded under the rules discussed in section 2 is taxable.

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Tax Benefit Rule Income Tax Course Cpa Exam Regulation Youtube

What Is The Pass Through Tax Deduction The Ascent By Motley Fool

Pass Through Entity Tax 101 Baker Tilly

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Taxation Of Social Security Benefits Mn House Research

Rsu Taxes Explained 4 Tax Strategies For 2022

Irs Confirms New 20 Pass Through Income Tax Deduction Can Be Used By Insurance Agency Owners Shareholders Agency Checklists

:max_bytes(150000):strip_icc()/TermDefinitions_grossincome.asp-559afff5d8fb40228d58da706b0859db.jpg)

What Is Gross Income Definition Formula Calculation And Example

Tax Benefit Rule Previous Deduction Recovery Los Angeles Cpa

A Smart Artist S Guide To Income Taxes The Creative Independent

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Home Office Tax Deduction For Small Businesses Mileiq

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate Earned Income For The Lookback Rule Get It Back