wyoming income tax rate

Up to 25 cash back Personal rates which generally vary depending on the amount of income can range from 0 for small amounts of taxable income to around 9 or more in some states. Wyoming has no state income tax.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Census Bureau Number of cities that have local income taxes.

. For income taxes in all fifty states see the income tax by state. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Select the Wyoming city from the list of popular cities below to see its current sales tax rate.

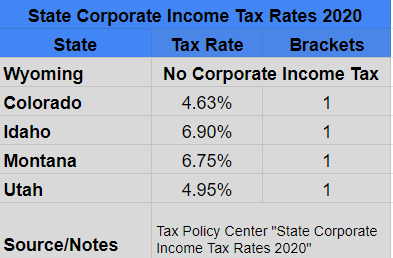

Wyoming has no estate or inheritance tax. Wyoming also has low property taxes with an average effective rate of just 057. Currently six states Nevada Ohio South Dakota Texas Washington and Wyoming do not have a corporate income tax.

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. The annual report fee is based on assets located in Wyoming. This tool compares the tax brackets for single individuals in each state.

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. Is Social Security taxable in Wyoming. Wyoming Is Income Tax Free Wyoming is one of seven states with no personal income tax.

Wyoming income tax rate. Wyoming does not have an individual income tax. Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2.

2022 List of Wyoming Local Sales Tax Rates. Wyoming has recent rate changes Thu Apr 01 2021. For married taxpayers living and working in the state of Wyoming.

For single taxpayers living and working in the state of Wyoming. New Resident Registration Form. There are a total of 105 local tax jurisdictions across the state collecting an.

Sales Use Tax Rate Charts. City Departments 62A District Court Pay A Ticket Court Records Search Making Payments Civil Division Traffic Criminal Division. For more information about the income tax in these states visit the Colorado and Wyoming income tax pages.

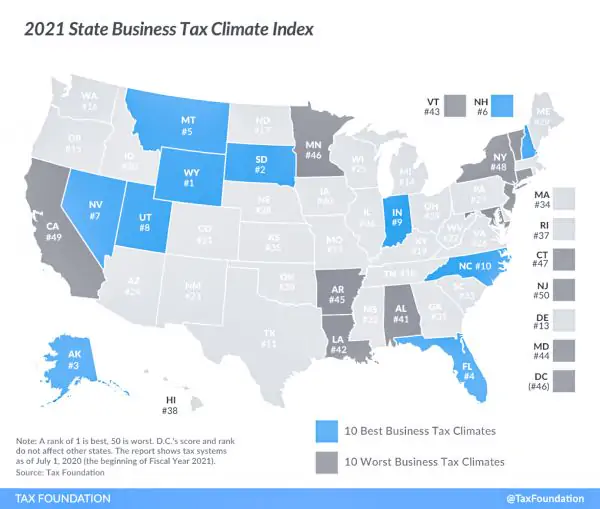

Wyoming may be the most tax-friendly state south of Alaska. Flat tax rate of 0 is applied to all taxable income. Wyomings average effective property tax rate is also on the low side ranking as the 10th-lowest in.

If youre starting a new small business congratulations new employer rates range from 0287 to 878 depending on your industry. I will share the other 8 states that like Wyoming do not charge individuals an income tax. Flat tax rate of 0 is applied to all taxable income.

Wyomings average effective property tax rate is also on the low side ranking as the 10th-lowest in. Both Wyomings tax brackets and the associated tax rates have not been changed since at least 2001. City of Wyoming Michigan 1155 28th St SW Wyoming MI 49509 616-530-7226 Fax 616-530-7200.

If you are a Wyoming business owner you can learn more about how to collect and file your Wyoming sales tax return at the 2022 Wyoming Sales Tax Handbook. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Call the unemployment tax division at 307 235-3217 to get your exact.

The sales tax in Wyoming is also low. Average Sales Tax With Local. The state and average local sales tax rate is 539.

Wyoming is one of only nine states in the country. Use this tool to compare the state income taxes in Colorado and Wyoming or any other pair of states. We can also see the flat nature of Wyoming state income tax rates at 0 regardless of income and status.

If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. The tax is either 60 minimum or 0002 per dollar of business assets whichever is greater. No Personal State Income Tax in Wyoming.

Popular Counties All A B C D E F G H I J K L M N O P Q R S T U V W Y. State Parks and Cultural. Its property tax for homeowners is 46th lowest.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Wyoming has no state income tax. Click here to view a copy of the City of Wyoming Income Tax Ordinance effective.

LLCs with 300000 of Wyoming assets or less pay the 60 minimum fee. Wyoming Paycheck Quick Facts. Registration Form for New Residents.

That does not levy a personal income tax on its residents. It does not have its own income tax which means all forms of retirement income will not be taxed at the state level. In case you are curious.

For 2022 Wyoming unemployment insurance rates range from 009 to 85 with a taxable wage base of up to 2770000 per employee per year. The average total sales tax rate is 539 counting both state and local taxes. 2020 Wyoming Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Wyoming also does not have a corporate income tax. 31 rows The state sales tax rate in Wyoming is 4000. A financial advisor can make planning an estate easier by helping you through the sometimes difficult aspects.

With local taxes the total sales tax rate is between 4000 and 6000. The average effective property tax rate in Wyoming is just 057. Lowest sales tax 4 Highest sales tax 6 Wyoming Sales Tax.

Wyoming is one of seven states with no individual income tax and one of only two with no corporate income tax South Dakota being the other one. Wyoming has no state-level income taxes although the Federal income tax still applies to income earned by Wyoming residents. Tax rate charts are only updated as changes in rates occur.

Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external collection agency. Wyomings sales tax is the 44th lowest in the nation and its tax on beer is the 50th unchanged since 1935 when it was set at 002 a gallon. Withholding Tax Form for Employer 2015 and forward Reconciliation Tax Form for Employer 2014 and prior Reconciliation Tax Form for Employer 2015 and forward Registration Form for Employers.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Wy State Income Tax Information

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

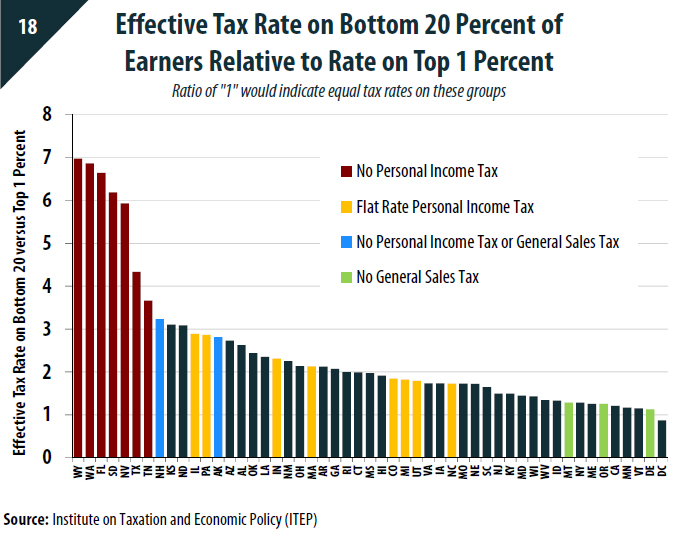

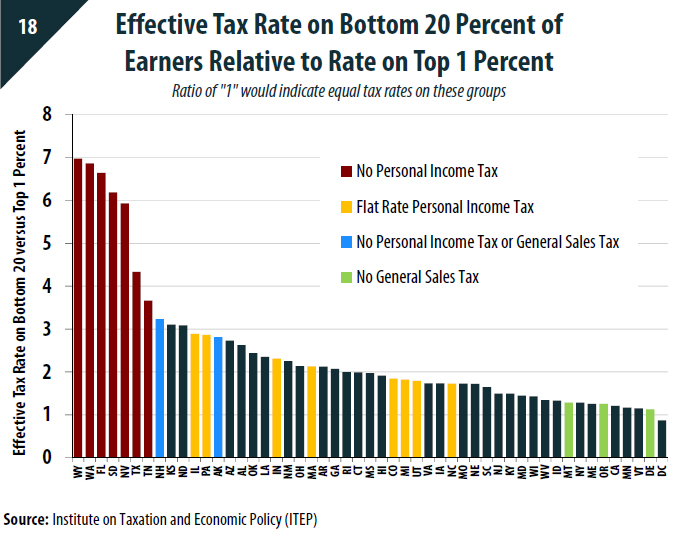

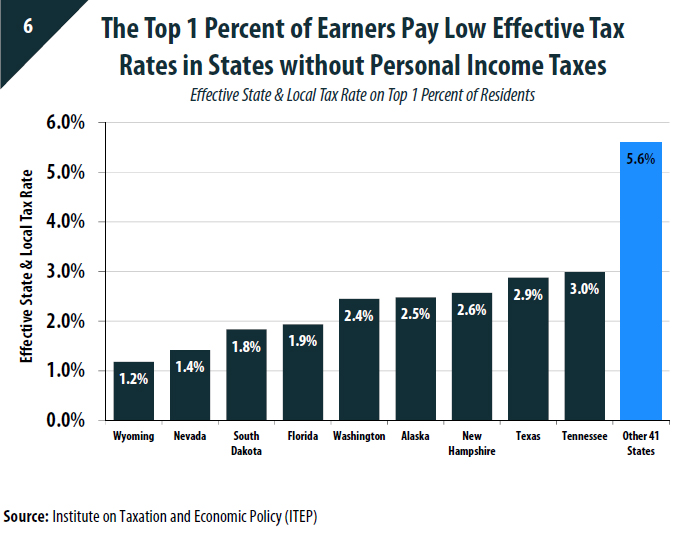

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

The Most And Least Tax Friendly Us States

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Income Tax Brackets 2020

I Fucking Love Maps Top Us State Marginal Tax Rates 2021 Source Http Ow Ly 4xn050etmly Facebook

2022 State Income Tax Rankings Tax Foundation

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

A Better Wyoming Everything You Know About Wyoming Taxes Is Wrong Itep

Wyoming Income Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered